Business

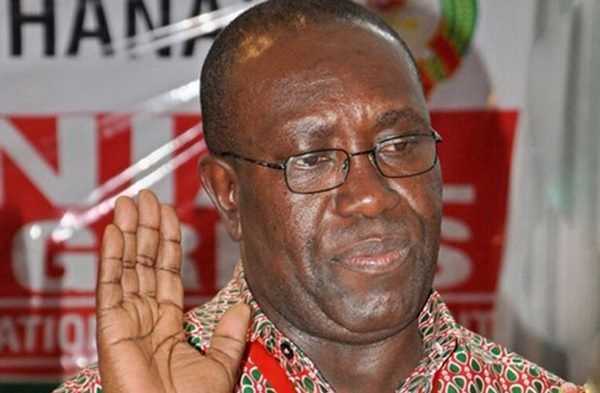

WORKERS WON’T PARTICIPATE IN DEBT EXCHANGE – TUC TO GOVT

-

Business2 years ago

Business2 years agoGHANA WILL REACH IMF BOARD APPROVAL BY MARCH ENDING – DKMNEWS.NET

-

Politics2 years ago

Politics2 years agoWE WILL PAY FOR HIS FILLING FEES, IF HE DOESN’T GO UNOPPOSED – BAWKU CENTRAL CONCERN YOUTH URGES – DKMNEWS.NET

-

News3 years ago

News3 years agoUE/R: SPILLAGE OF THE BAGRE DAM , DESTROYS OUR CROP – FARMERS LAMENTS

-

Politics1 year ago

Politics1 year agoWe will build Black Stars around local players – John Dramani Mahama

-

News3 years ago

News3 years agoEARTH TREMOR HITS PART OF ACCRA.

-

Business2 years ago

Business2 years agoTema Oil Refinery has missing $2.5 of crude condensed- Energy Minister

-

National1 year ago

National1 year agoDr Bawumia is the best economist Ghana has ever had

-

Media2 years ago

Media2 years agoBongo Ideas claims most girls stinks in attempt to get back at the Knust tweet saga